Managing a vacation rental is often a balancing act between hospitality and protection. You want your guests to feel like they are in a home away from home, yet you are naturally protective of your investment. One of the most common questions new and seasoned hosts ask is: "How do I protect my property without scaring away potential bookings?"

The debate usually boils down to two heavyweights: the traditional security deposit and modern damage insurance. Both have their loyal fans, and both serve the same ultimate goal—protecting your bottom line—but they do so in very different ways. Choosing the right one can change your entire guest experience and your operational workflow.

What Is a Security Deposit?

For decades, the security deposit has been the gold standard for property protection. It is a straightforward concept that most people understand from renting apartments or leasing cars. It creates a direct financial link between the guest’s behavior and their wallet.

Definition

A security deposit is a specific sum of money paid by the guest before check-in. This money is held by the host or the booking platform as collateral against potential damages, excessive cleaning needs, or violations of house rules during the stay. If the property is returned in good condition, the money goes back to the guest.

How It Works

When a guest books your vacation rental, they are notified of a deposit requirement. Depending on the platform, the funds might be physically charged and held in an escrow-style account, or a "soft hold" might be placed on their credit card. After the guest checks out, you—as the host—have a specific window (usually 7 to 14 days) to inspect the home. If you find a broken lamp or a stained rug, you claim a portion of that deposit. If everything is perfect, the hold is released, and the guest sees their money again.

Pros and Cons

The Pros:

- Psychological Skin in the Game: There is a powerful psychological deterrent when a guest knows $500 of their own money is at risk. They tend to be more mindful of house rules.

- Immediate Cash Flow for Repairs: You don't have to wait for an insurance adjuster. You already have the funds to fix the issue immediately.

- Zero Premium Costs: There are no monthly fees or premiums to pay. If no damage happens, no money is lost by anyone.

The Cons:

- Booking Friction: This is the biggest hurdle. High deposits can lead to "sticker shock." A guest might love your home but choose a competitor because they don't want to tie up $1,000 on their credit card during their vacation.

- Administrative Headaches: You have to be meticulous with inspections and photos. Managing disputes over a $50 cleaning fee can lead to nasty reviews and a lot of back-and-forth emails.

- Legal Restrictions: Some regions have very strict laws about how deposits must be held and returned, adding a layer of compliance risk.

What Is Damage Insurance?

As the vacation rental industry has professionalized, damage insurance (sometimes called a damage waiver) has become a favorite for hosts who want to scale their business and reduce friction.

Definition

Damage insurance is a non-refundable policy that the guest purchases (or the host includes in the fee) for a small, flat rate. Instead of a large deposit, the guest pays a tiny fraction—perhaps $25 to $50—to cover accidental damages up to a much higher limit, often $1,500 or $3,000.

How It Works

During the booking process, the guest pays for the policy. If a "whoops" moment happens—like a child spilling grape juice on a white sofa or a suitcase scuffing a wall—the host doesn't charge the guest. Instead, the host filing a claim with the insurance provider. The provider reviews the photos and receipts and reimburses the host directly for the repair or replacement cost.

Pros and Cons

The Pros:

- Higher Conversion Rates: Removing a $500 deposit and replacing it with a $30 "peace of mind" fee makes your listing much more attractive. It lowers the barrier to entry for travelers.

- Broad Protection: A security deposit is limited to the amount held. If a guest causes $2,000 in damage but your deposit was only $500, you are in trouble. Insurance often covers significantly higher amounts.

- Eliminates Guest Conflict: You don't have to be the "bad guy." You can tell the guest, "Don't worry, it's covered by the insurance," which preserves the relationship and your 5-star review.

The Cons:

- The "Invincibility" Complex: Some argue that because guests have paid for insurance, they might be less careful. They might feel they have a "license to spill."

- Claims Documentation: You must be very disciplined about taking "before and after" photos. If you miss a deadline or don't have proof, the insurance company might deny the claim.

- Non-Refundable Cost: Even the best guests who leave the house spotless will never see that insurance money again.

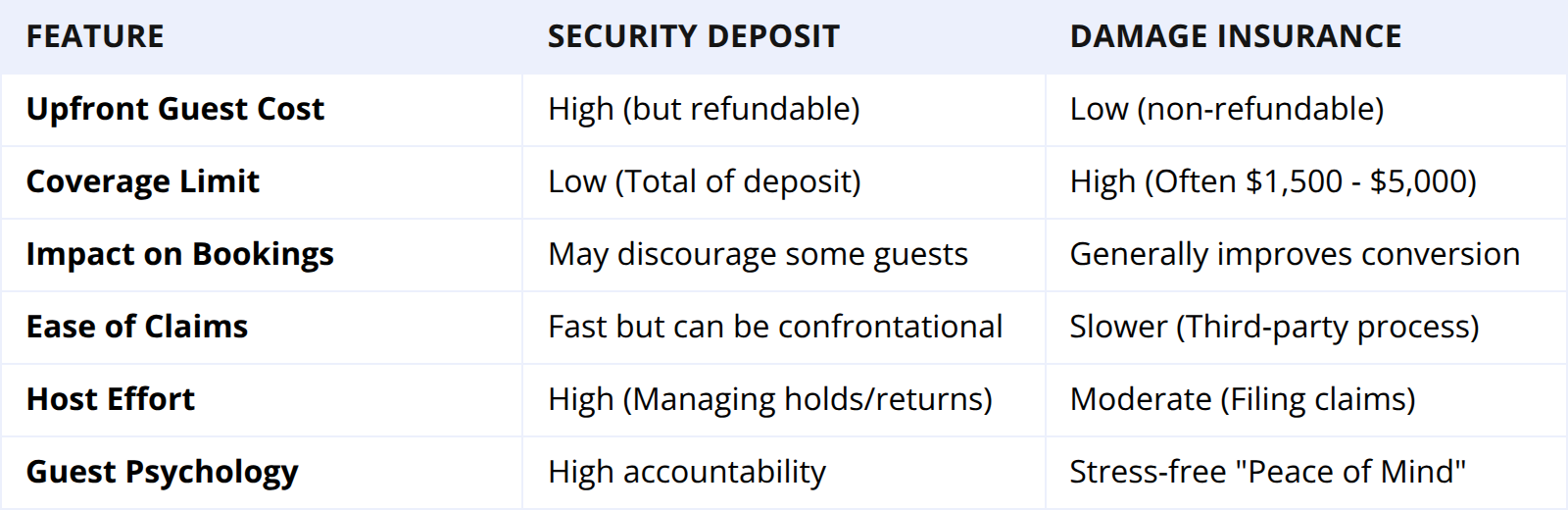

Comparison: Security Deposit vs. Damage Insurance

Which One Should You Choose?

Deciding between these two isn't about finding a "better" product; it's about finding the right fit for your specific business model.

If you own a high-end luxury estate filled with curated antiques and original art, a security deposit is likely your best friend. In the luxury market, guests are often more accustomed to deposits, and you need that immediate accountability to protect irreplaceable items. It acts as a filter to ensure you are getting guests who respect the value of the home.

On the other hand, if you are managing a cozy beach condo or a high-turnover city apartment, damage insurance is almost always the winner. In these markets, competition is fierce. If your neighbor doesn't require a deposit but you do, you'll likely see your occupancy rates drop. Insurance allows you to stay competitive while still sleeping soundly at night knowing the "big stuff" is covered.

Tips for Implementation

Regardless of which path you take, success lies in the execution. Here are a few ways to make either system work better for you:

- Transparency is Key: Whether it is a deposit or a fee, mention it clearly in your house rules. No guest likes a surprise charge at the final checkout screen.

- The Power of the "Welcome Book": Use your digital or physical welcome book to remind guests that while they are covered (insurance) or their deposit is safe, you still value your home. A personal note about how much you care for the property goes a long way in preventing "accidental" neglect.

- Invest in a Good Inspection App: If you use insurance, you need proof. Use apps that allow your cleaning crew to snap timestamped photos of every room after every stay. This makes filing insurance claims—or keeping a deposit—an open-and-shut case.

- Consider the Hybrid Model: Some savvy hosts charge a very small, manageable security deposit (like $150) alongside a basic insurance policy. This gives you the psychological deterrent of the deposit and the high-limit protection of insurance.

Conclusion

At the end of the day, your vacation rental is a business, and risk management is part of the job. Choosing between a security deposit and damage insurance comes down to your tolerance for risk and your desire for growth. Deposits offer direct control and guest accountability, while insurance offers scalability and a smoother booking experience.

Take a look at your booking data. If you notice people viewing your page but not hitting "book," your deposit might be too high. If you find yourself constantly arguing with guests over small stains, insurance might save your sanity. Whichever you choose, make sure it serves your goal of providing an amazing stay while keeping your investment safe.