Every hotel manager knows the magic of Online Travel Agencies (OTAs). They bring visibility, reach, and bookings from all over the world. But with that power comes cost: OTA commission rates and OTA fees slice into revenue. If you're a hotel trying to balance profit with exposure, understanding these fees isn’t optional—it’s essential. This guide explains what OTA commissions are in 2025, how much they typically are, how small hotels feel the impact, and what strategies help reduce reliance on OTAs without losing bookings.

What is an OTA Commission Rate?

An OTA commission rate is the percentage of the booking value that a hotel must pay an OTA when that OTA delivers a reservation. It covers the OTA’s role in marketing, payment processing, customer reach, and booking infrastructure. Often, OTA fees go beyond just that percentage—there can be extra charges for premium placement, promotional exposure, or added services.

Key things to know:

- The commission may include or exclude taxes (VAT, GST) depending on contract and region.

- Some OTAs charge variable rates depending on property size, market, occupancy, or how visible you want to be on their platform.

- Other “hidden” costs: fees for listing enhancements, paying for ranking boosts, or mandatory participation in promotions.

Understanding the full fee structure in your OTA contract is critical. Otherwise, what looks like a 15% commission could end being much higher.

How Much Do Major OTA Commission Rates Cost (with 2026 Updates)

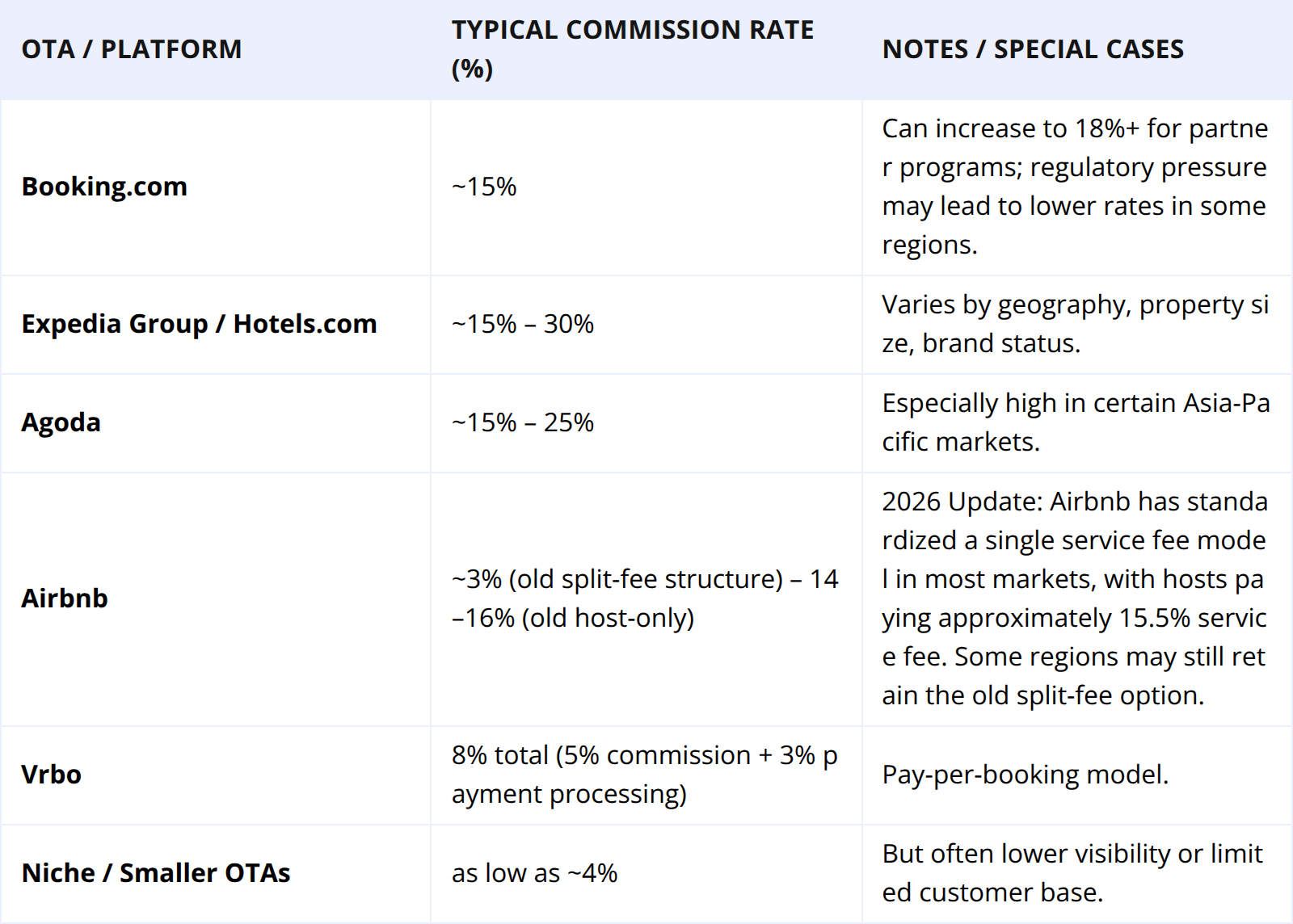

Here are typical commission ranges for well-known OTAs as of 2025— and the latest updated Airbnb fee structure for 2026., based on recent industry data. These figures include base commission rates; additional fees or promotion costs may push the effective commission higher.

Some general truths from recent reports:

- Most major OTAs charge between 15-30% commission per booking.

- Niche OTAs or platforms with limited services sometimes offer rates under 10%, but trade-offs include less exposure, fewer international travelers, or fewer marketing tools.

The Impact of OTA Commissions on Small Hotels

Small hotels often feel OTA fees more sharply. Here’s how:

- Profit margins shrink. A hotel selling a room for $200 that pays 20-25% commission loses $40-$50 just to the OTA. Every extra cost (staff, housekeeping, amenities) makes that loss sting.

- Price leakage. Guests compare across OTAs; you may feel pressure to offer discounts, which reduce your average daily rate (ADR). To compete on OTA platforms, some hotels lower rates or absorb promotion fees, further eroding profit.

- Brand connection suffers. OTA bookings often mean limited direct communication with guests before arrival. Upselling, cross-selling, and building customer loyalty becomes harder.

- Dependency risk. Heavy reliance on OTA bookings leaves hotels vulnerable to policy changes, commission hikes, algorithm changes, or even platform outages. For small hotels, a sudden change from a major OTA can hit occupancy significantly.

- Marketing cost disguised. Commissions are part marketing spend: paying OTAs for visibility. But this hides the cost of marketing you could control, such as direct digital campaigns, your own website, or loyalty programs.

Strategies to Reduce OTA Commission Dependency

Reducing reliance on OTAs does not mean cutting them out entirely. It means finding balance and shifting more profitable bookings to direct channels. Here are proven strategies:

1. Improve your direct booking channels.

- Build a hotel website with clear booking engine, fast load times, mobile optimization.

- Emphasize “best price guarantee” or “exclusive perks” for direct booking.

- Use strong visuals, clear policies, flexible cancellation.

2. Offer incentives for booking direct.

- Free perks: breakfast, upgrades, spa vouchers.

- Loyalty rewards: points, discounts for return guests.

- Exclusive deals via email list or social media.

3. Use rate parity smartly.

- Many OTAs used to demand that your lowest rate must be shown through them as on your site. Regulatory changes (in some regions) allow flexibility. Use this to your advantage, offering better deals or incentives on your channels.

4. Negotiate commission terms.

- If your property has consistent bookings, occupancy, or is unique, some OTAs may agree to lower rates or different commission tiers.

- Review contracts: are promotional fees or listing upgrade fees negotiable?

5. Optimize channel mix and inventory allocation.

- During high demand periods, shift more inventory into direct channels.

- Keep some rooms off OTAs or limit their exposure for certain dates.

- Monitor the performance (ADR, RevPAR) by channel and adjust.

6. Invest in marketing outside OTAs.

- SEO: so people searching hotels in your area find you first.

- Local SEO: maps listings, “hotels in [town]”.

- Email marketing & remarketing to past guests.

- Social media content + influencer partnerships.

7. Leverage technology.

- Use booking widgets that compare your site’s price to OTA prices.

- Use CRM or PMS systems to track guest behavior, encourage repeat bookings.

- Use analytics to track which channels deliver profit, not merely volume.

Conclusion

OTA commission rates and OTA fees are a real cost of doing business in hospitality. In 2025, typical rates on major platforms sit around 15-30%, with niche OTAs sometimes much lower. For small hotels, those fees can erode profits, reduce flexibility, and weaken brand-guest connections.

Yet, hope lies in smart channel management. By building strong direct booking channels, offering incentives, negotiating terms, and using technology and marketing wisely, hotels can keep OTAs in their distribution strategy while reducing dependency. Profit need not be sacrificed for visibility.

If you begin applying some of these strategies today, each small booking you shift from an OTA back to direct could make a visible difference in revenue and guest loyalty. Your bottom line, and your brand, deserve that.