The world of hospitality thrives on welcoming guests, delivering exceptional service, and, ultimately, managing a profitable business. Yet, a fundamental challenge—and a crucial compliance hurdle—lurks behind every booking: the hotel tax, also known as the hotel occupancy tax or lodging tax.

For hotel managers, this isn't just a fee; it's a complex, multi-layered responsibility. Mishandling it can lead to stiff penalties, costly audits, and frustrating guest disputes. This comprehensive guide provides you with the essential knowledge and actionable checklist you need to navigate the hotel tax landscape confidently, ensuring your property stays compliant and financially sound.

What is Hotel Tax?

A hotel tax is a fee charged by government bodies—like state, county, or city governments—on room rentals for hotels, motels, and other short-term stays.

Think of your hotel as the middleman. You are required to collect this tax from the guest and then send it to the correct government agency. This tax is not optional income for the hotel; it is a mandatory government charge.

The name for this tax can change, but it all means the same thing:

- Hotel Occupancy Tax (HOT): A common term that refers to a room being occupied.

- Lodging Tax / Bed Tax: Simpler names for the tax on providing a place to sleep.

- Transient Occupancy Tax (TOT): Used in many US areas, this name points out that the guests are temporary visitors.

Unlike a general Sales Tax that applies to many goods and services, the hotel tax is specifically for renting a room. An important point for hoteliers is that this tax is often charged on top of the regular sales tax. This creates a double tax that can surprise guests and makes bookkeeping more difficult.

Why is Hotel Tax So High?

If you've ever looked at a guest's final bill and noticed the tax line seems disproportionately large, you've touched upon the single greatest challenge of managing hotel taxes: their sheer complexity and height.

The perception that hotel occupancy tax is "high" stems from a combination of three primary factors:

1. Layering of Jurisdictions

Hotel taxes are rarely just one number. In many regions, the final rate is a stack of fees imposed by different government levels:

- State Tax: A foundational percentage set by the state.

- County Tax: An additional percentage levied by the county government.

- City/Municipal Tax: Often the largest layer, set by the local city to fund specific projects.

For example, a state might have a 6% tax, the county adds 2%, and the city contributes another 5%. Your final quoted rate to the guest is a combined 13%. This layering rapidly inflates the total amount.

2. Earmarked Funding for Tourism

A significant portion of the hotel tax revenue is earmarked—or legally designated—for specific tourism and development projects. Because the tax is paid by visitors (who don't vote locally), local governments view it as a politically easy way to raise large amounts of capital for popular initiatives like convention center expansion, sports stadium debt, and destination marketing. These projects require massive funding, which translates into higher tax rates.

3. High-Traffic Area Premium

In major tourism hubs and destinations, tax rates climb even higher to cope with the increased strain visitors place on local infrastructure—roads, public transport, police, and sanitation services.

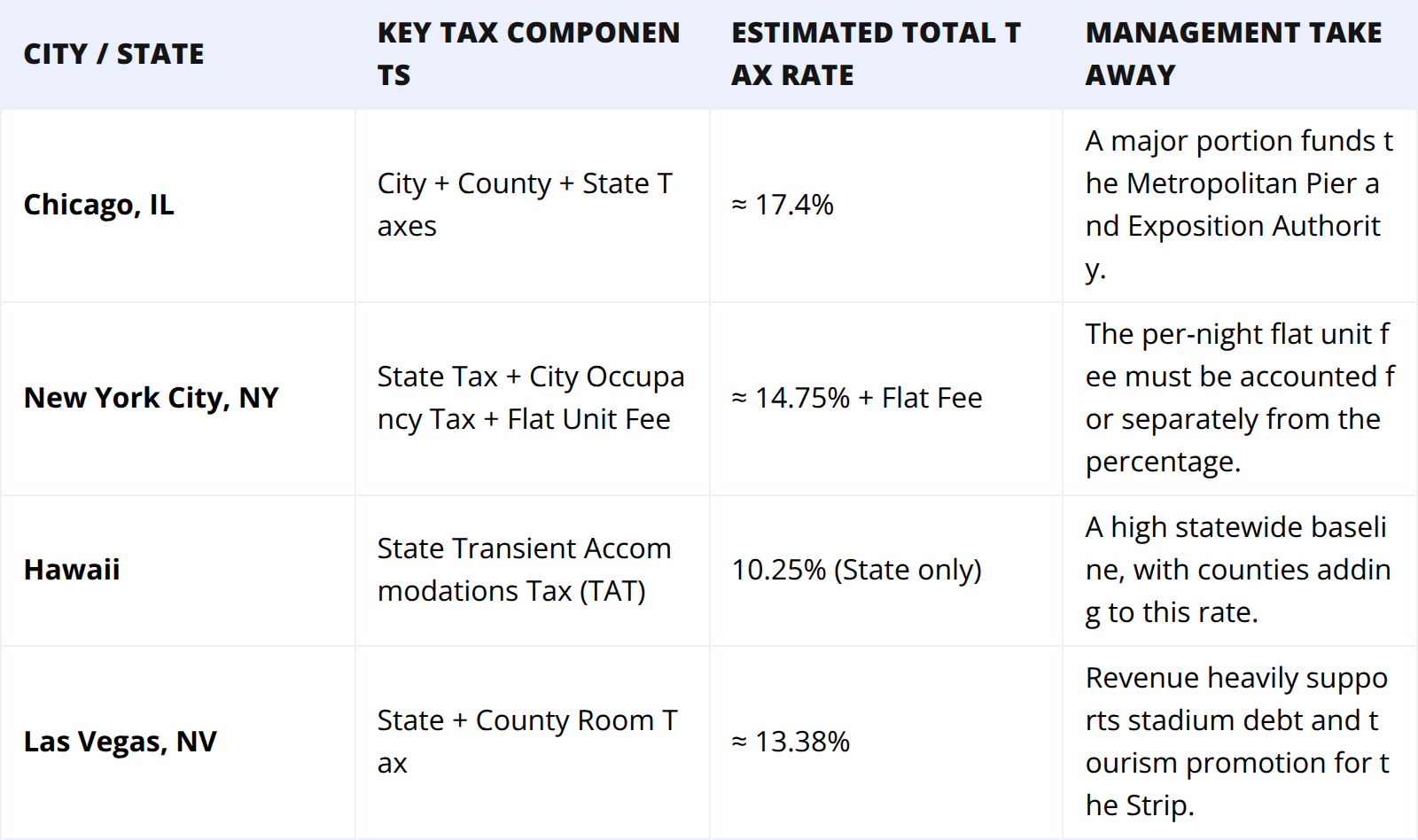

High-Rate Hotspots: Tax Examples

Managers in these areas must be especially vigilant, as the combined rates push well past the 15% mark:

How to Calculate Hotel Tax

Getting the tax calculation right is essential for any hotel. Even a small mistake can add up to a big problem over many bookings, leading to shortfalls and penalties.

The process is simple, but you need to be sure you include every tax that applies.

Step-by-Step Guide

- Find the Base Room Rate:

Start with the room’s price for the night before any taxes or fees. This is the amount you will use to calculate the tax. - Identify All Tax Rates:

Check the websites for your local city, county, and state tax offices to find all the percentage rates you need to charge.

Example: State Tax (6%) + City Tax (5%) = Total Tax Rate (11%) - Add Any Flat Fees:

Some places, like New York City, also charge a set fee per room each night (for example, $1.50). You add this fee on after you calculate the percentage tax. - Calculate the Total Tax:

Multiply the Base Room Rate by the total tax percentage, then add any flat fees.

Formula Example:

Base Rate: $200

Total Tax Rate: 11% (or 0.11)

Flat Fee: $1.50

Tax Amount: ($200 x 0.11) +$1.50 = $22.00 +$1.50 = $23.50 - Create the Final Bill:

Add the total tax you just calculated to the base room rate.

Final Price: $200 +$23.50 = $223.50

Helpful Tip: Never round the tax percentages themselves. Use the exact numbers in your hotel’s software to avoid small errors that can grow into large ones over time.

What is the Purpose of Hotel Occupancy Tax?

Understanding where the money goes is essential for manager accountability and helps when addressing guest inquiries about the cost. The revenue generated from the hotel occupancy tax is primarily used to fund public services and improve the overall visitor experience in the destination.

The funds are commonly directed toward four key areas:

1. Tourism Promotion and Marketing

This is often the most significant beneficiary. Tax revenue finances destination marketing organizations (DMOs) and tourist boards. These groups use the funds for global advertising campaigns, hosting travel writers, and attending trade shows to attract more visitors, directly benefiting your hotel's bookings and revenue.

2. Infrastructure Improvements

Increased visitor traffic puts significant wear and tear on local infrastructure. Hotel taxes pay for the maintenance and expansion of public transport, roads, airports, and utilities that tourists rely on.

3. Community Services and Development

Funds often support local amenities that enhance the visitor experience, such as public parks, convention centers, cultural venues (museums, theaters), and special events that draw crowds.

4. Public Safety and Sanitation

Higher occupancy means greater demand for municipal services. Tax dollars help fund increased police presence, emergency services, and more robust sanitation and waste management to keep the tourist areas clean and safe.

Best Practice Checklist for Hotel Managers

Achieving flawless tax compliance requires dedicated systems and protocols. Use this checklist to review your current processes and ensure you meet the highest standards of financial responsibility.

1. Automate with Your PMS

- System Configuration: Ensure every tax rate (state, county, city, flat fees) is correctly entered and verified in your Property Management System (PMS).

- Automated Reporting: Use your PMS to create monthly or quarterly tax reports automatically. This prevents mistakes from manual data entry.

- Package Itemization: Set up your PMS to separate the room charge from other services (like food, spa, or parking) in package deals. This ensures tax is only charged on the room portion.

2. Master Tax Exemptions

- Know Local Rules: Familiarize yourself with all local and state exemptions (e.g., government employees, non-profit groups, stays over 30 days).

- Mandatory Documentation: Do not grant an exemption without the required documentation (e.g., government ID, tax exemption form). Train front desk staff to collect and archive these documents securely for audit defense.

3. Ensure Financial Transparency

- Booking Engine Clarity: Your direct booking engine and communications must display the total cost, including all taxes and fees, before the guest confirms the booking.

- OTA Reconciliation: Regularly cross-reference the tax amounts collected by Online Travel Agencies (OTAs) with your PMS records, especially concerning "Tax Recovery Charges," to prevent shortfalls.

4. Stay Ahead of Changes

- Monitor Local Authorities: Tax rates and rules can change with little notice (e.g., new city ordinances). Subscribe to official alerts from your state and local tax collection agencies.

- Dedicated Account Support: Maintain a strong relationship with a local accountant or tax advisor specializing in hospitality. Their expertise is invaluable for interpreting new regulations and preparing for audits.

Conclusion

The hotel tax is more than just a line on a bill; it’s a core legal and financial duty that supports a strong tourism economy. For a hotel manager, mastering the intricacies of the hotel occupancy tax is non-negotiable.

By moving away from manual tracking and embracing automated systems like a robust PMS, staying current on local legislation, and maintaining meticulous records for exemptions, you can transform tax compliance from a high-risk burden into a smooth, efficient process. This mastery not only protects your hotel from costly penalties but also demonstrates your commitment to the financial health and reputation of your property within the community.